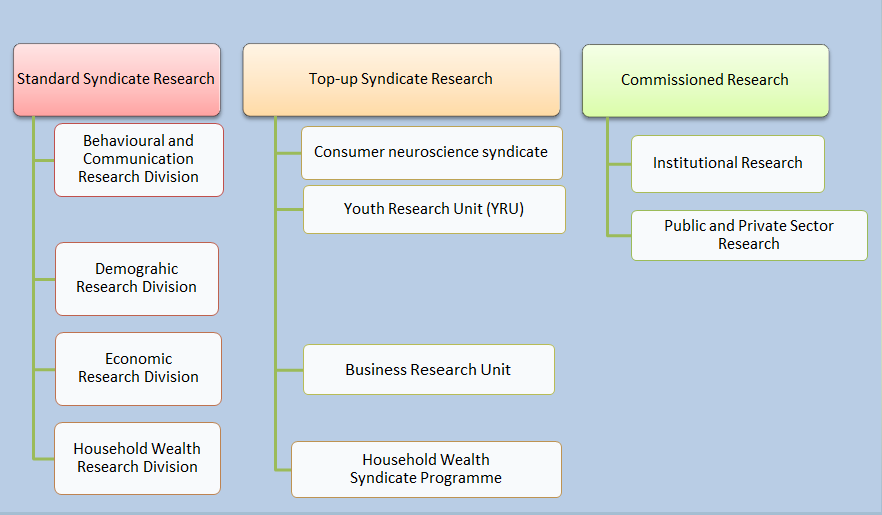

Research Functions

Standard Syndicate Research

The research focus of the Bureau of Market Research (BMR) is centered on the activities of the following four research divisions:

- Behavioural and Communication Research Division

- Demographic Research Division

- Economic Research Division

- Household Wealth Research Division

BMR Integrated Suite of Economic Models

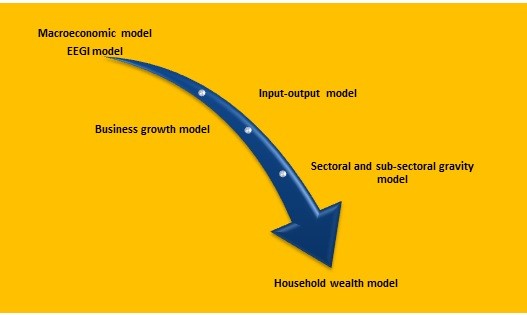

The BMR has developed an integrated suite of economic models with the aim of providing modelling solutions, impact analyses, comprehensive insights and forecasts of greatest likelihood to BMR members, clients, policy and research institutions as well as government (national, provincial and local). More specifically, the suite of models consists of six separate models that feed into each other and are maintained by a team of economists, accountants and statisticians. These include:

- Macroeconomic model. This model includes several economic time series that are linked mathematically according to a Keynesian demand side structure in order to derive macroeconomic forecasts. The ‘Keynesian demand side structure’ of this model implies that economic growth outcomes such as growth in gross domestic product (GDP), gross domestic expenditure (GDE), labour compensation and employment are driven by changes in aggregate demand for goods and services produced in the economy. The model is primarily used for forecasting purposes and is updated on a monthly basis.

- Input-output model. This model provides a mathematical representation of the South African economy’s sectoral and sub-sectoral linkages as well as the linkages of such sectors and subsectors with final demand (ie by households, government and the rest of the world) for goods and services. By providing such demand and supply-side linkages this model represents demand and supply patterns in the economy in equilibrium with each other. It is primarily used for economic impact analyses and is updated annually.

- Business growth model. This model is based on detailed formal business turnover/income, expenditure, profitability, assets, liabilities, business growth, enterprise formation and attrition, legal structures and business employment from a variety of datasets. It forms the institutionalisation (corpographics) of the sectoral and sub-sectoral structure of the South African economy. The model, inter alia, is being used to analyse the business dynamics and growth of the South African economy that ultimately determines the growth and employment performance of a free enterprise economy.

- Sectoral and sub-sectoral gravity model. This model is a supply-side model providing detailed insights regarding the sectoral and sub-sectoral distribution of economic activities geographically. The model provides detailed insights regarding sectoral and sub-sectoral business growth and contraction and is updated annually.

- Early economic growth indicator (EEGI) model. This model is based on an index of five economic variables and is updated on a daily basis. The model calculates a model-based leading indicator of economic activity that provides a daily indication of where South Africa finds itself on the economic cycle.

- Household wealth model. This model is based on detailed household income, expenditure, assets and liabilities data derived from numerous datasets that are updated annually, including the financial wellness survey that is conducted in-house. The model is used to derive personal income, household income, household expenditure, household assets, household liabilities and household net wealth (equity) estimates in population and monetary terms, disaggregated by a number of demographic variables.

The suite of six BMR economic models indicated above comprises of separate models that feed into each other via a complex transmission path in order to provide comprehensive insights to research users. Both the macroeconomic and EEGI models are used to generate macroeconomic estimates and forecasts of greatest likelihood. The findings are then imputed into (i) the input-output model to determine how macroeconomic changes will translate into changes in household income by income group and (ii) the sectoral and sub-sectoral gravity model to determine sectoral and sub-sectoral gains ascribed to the forecasted macroeconomic dynamics by province. Finally, the findings of the input-output and gravity models are imputed into the household wealth model in order to derive household income, expenditure, asset and liability estimates of greatest likelihood.

Top-up Syndicate Research

1. Household Wealth Syndicate Programme (HWSP)

- Personal income forecasts

- Personal income segmentation

- Household income and expenditure forecasts

- Household income and expenditure segmentation

- Market sizing of households income and expenditure

2. Business Research Unit (BRU)

The relatively low economic growth and the high unemployment rate in South Africa, largely induced entrepreneurship and business formation and growth. In response to the renewed focus on business development and increased demand for business information on, among others, the number of South African business entities by province, turnover group, industry, gross operating surplus, employment, entrepreneurial activities and business formation and the legal status of businesses, the BMR established a Business Research Unit (BRU). Whereas the formal business sector is the primary focus of the BRU, its main activities are devoted to the construction of a business database containing information from various secondary data sources on the mentioned business variables in a time-series format to allow trend and structural analysis. In fact, the BRU has started to embark on a dedicated business research and modelling programme with specific emphasis on integrating business dynamics into a sectoral and macroeconomic model. The unit operates as a syndicated business research unit consisting of sponsor members that qualify for client specific data packaging and interpretation as well as in-house presentations and workshops.

3. Consumer Neuroscience Syndicate Research (CNSR)

The Behavioural and Communication Research Division of the BMR at the start of 2016 introduced the first Consumer Neuroscience Research Laboratory in Africa. This laboratory aims to find biological explanations for human behaviour and will be focused on current and future uses of neuroscience in business. Against this background, the BMR has designed a consumer neuroscience syndicate membership model whereby businesses can combine funds to form an exclusive research syndicate. Although the format of the consumer neuroscience syndicate will primarily take the form of an ‘open syndicate’ whereby interested parties join efforts and funds to form such ‘open’ syndicate, the BMR will, depending on the nature and scope of research projects, also consider an omnibus survey approach whereby an individual client’s portion of the research will remain the client’s exclusive property.

Institutional / Organisational Research

- Student satisfaction and perceptions studies

- Staff satisfaction studies

- Employee health and wellness assessments

- Staff morale surveys

- Diversity and transformation surveys

- Skills and competency surveys

Commissioned Research

- Household satisfaction surveys

- Business satisfaction surveys

- Demographic projections

- Socioeconomic impact studies on gambling

- Input-output modelling to assess the economic impact

- Investor research

- Capacity-building workshop on population projections

- Consumer insight studies

- Macro- and micro-econometric modelling

- Demographic modelling and analysis

Last modified: Mon Aug 07 18:02:03 SAST 2023